Ok, that might be a stretch, but if your kid isn’t investing, they’re already falling behind.

Custodial investment accounts are at an all-time high, and 23% of teens are actively investing.

Source: Wall Street Journal

Why?

Because information and opportunity is much more readily available than it has been in the past. Nearly 65% of Gen Z reported that they learned about investing in middle school or high school, compared to only 38% of Millennials.

So if your teen isn’t already investing, I can almost guarantee that they’d be game for it if you give ‘em the opportunity.

Here’s how to get started:

Pick a platform

This is the easy part.

If you have an investment portfolio, chances are your brokerage offers custodial investment accounts for kids. Easy peasy.

The major players like Vanguard, E-Trade, and Charles Schwab all provide custodial accounts.

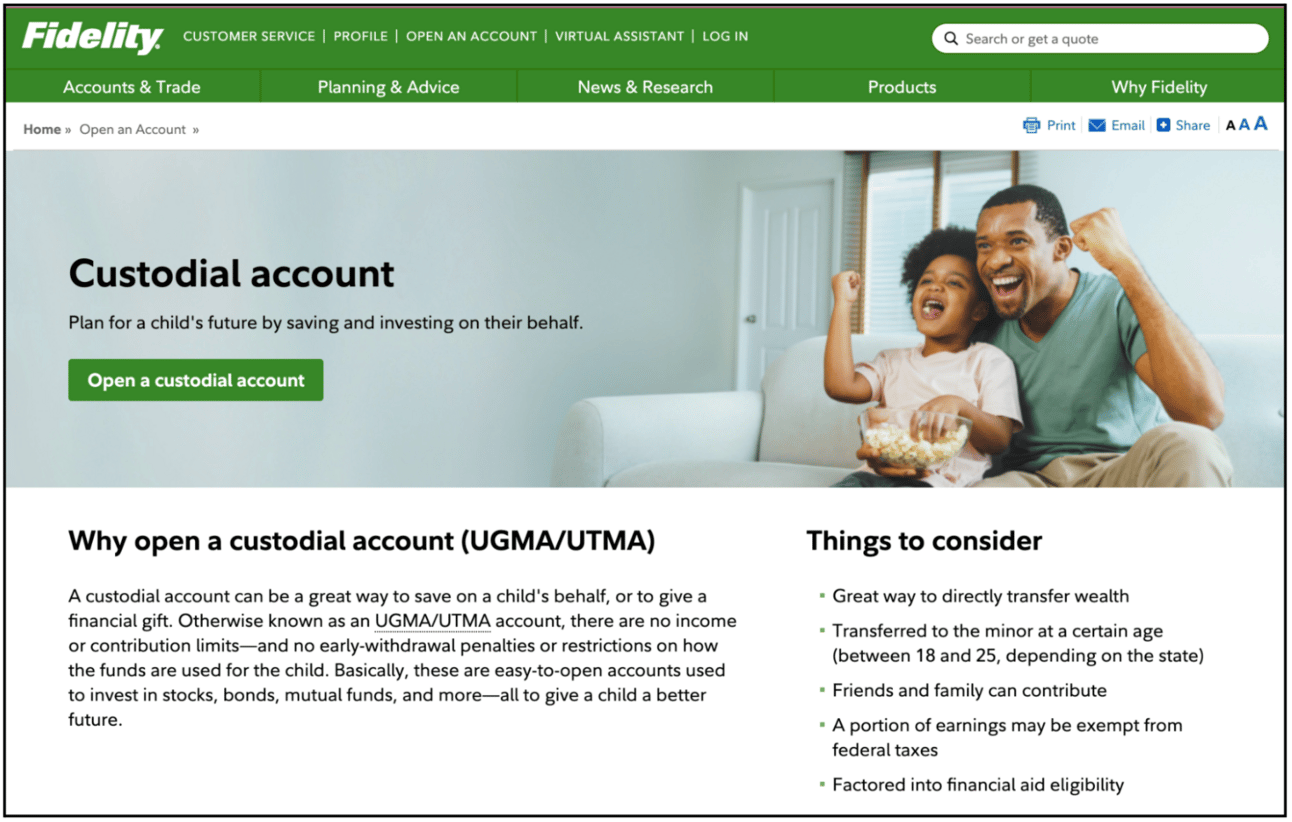

And Fidelity’s custodial account is frequently cited as one of the top trading accounts for kids. 👊

Source: Fidelity

There are also some great apps to consider that can incorporate a youth debit card, parental controls, and other cool features that teach kids about money:

Greenlight (6m users)

Stockpile (1m users)

Acorns Early (6m users)

Source: Greenlight

And while Robinhood doesn’t offer custodial accounts, some parents choose to open an account in their own name and provide their kid with access to it because of its fractional share offerings and 0% commissions.

So pick one, and just get started!

Five key tactics to train talented teen investors

1. Make it exciting 🎉

Investing is about more than just numbers — it's a mindset. Encourage your kid to invest in companies or sectors they're passionate about.

It's easier to learn when it's something that excites them.

Use their interests as a springboard into broader financial literacy topics.

2. Chat about it at the dinner table 🍽️

Normalize discussions about finances.

Share your experiences — the good, the bad, and especially the ugly.

Transparency about money removes the taboo and prepares your kid for realistic expectations in their investing journey.

3. Teach due diligence 📚

Only sheep follow the hype. 🐑

In an age of meme stocks and viral investments, understanding the “why” behind an investment is crucial.

Encourage your kid to research, ask questions, and develop a healthy skepticism about where they put their money.

4. Diversify on their terms 📊

Explain the concept of diversification using scenarios that actually mean something to them.

For example, if they spent 100% of their time and energy only applying to one college, it might pay off big, or they might not get in at all, leaving them with no other options.

But if they spread their time and energy across 10 college applications, their likelihood of being admitted to at least one rises substantially.

5. Learn from mistakes 🤦

Not every investment will pan out, and that’s okay.

Frame losses as learning moments, not failures. It's about the long game, and resilience in the face of setbacks is a priceless lesson. 👊

—

Investing is a powerful tool for financial freedom and security.

Starting young imbues your kid with not just the skills, but also the mindset to navigate their financial future. It’s not just about making money — it’s about making informed, confident, and strategic decisions.

Equip them with the knowledge, but let them steer the ship. 🚢